The Consumer Price Index (CPI) inflation report for January 2025 provides critical insights into the economic health and spending power of households. As one of the most watched economic indicators, CPI measures the average change over time in the prices paid by urban consumers for a market basket of goods and services. This blog explores the key details from the January 2025 CPI report, shedding light on trends, contributing factors, and implications for various stakeholders.

Overview of January 2025 CPI Inflation Report

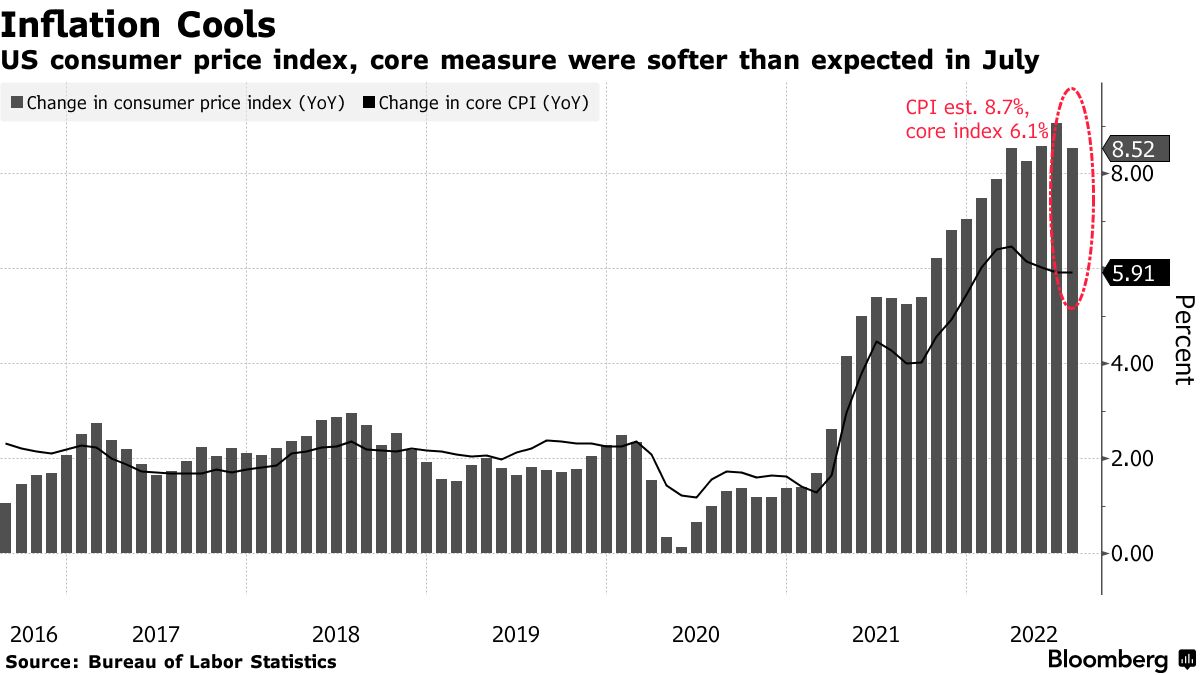

The January 2025 CPI report indicates that inflation remains a central concern for policymakers, businesses, and consumers. The overall CPI rose by 0.3% on a seasonally adjusted basis, while the year-over-year inflation rate stood at 4.2%. Although this represents a slight deceleration compared to the 4.5% rate recorded in December 2024, it highlights persistent price pressures across key categories.

Core CPI, which excludes volatile food and energy prices, increased by 0.4% month-over-month and 3.8% year-over-year. This suggests underlying inflationary pressures are still significant despite easing in headline figures.

Key Contributors to Inflation

1. Energy Prices

Energy costs have long been a volatile component of CPI. In January 2025, energy prices rose by 1.1%, driven primarily by higher crude oil and natural gas prices. The ongoing geopolitical tensions in major oil-producing regions, coupled with strong winter demand for heating, contributed to the uptick.

- Gasoline: Prices at the pump increased by 0.8%, reflecting global supply constraints and seasonal demand.

- Natural Gas: A 2.2% rise in natural gas prices significantly impacted heating costs for households in colder climates.

2. Food Prices

Food inflation remained elevated, with the category recording a 0.6% month-over-month increase. Key drivers included:

- Meat and Poultry: Prices rose by 0.7% due to higher feed costs and supply chain disruptions.

- Dairy and Eggs: A 1.2% increase was attributed to production challenges and rising transportation costs.

- Fresh Produce: Weather-related disruptions caused a 0.9% spike in fruit and vegetable prices.

3. Shelter Costs

The shelter index, a major component of CPI, climbed by 0.5% in January, contributing significantly to the overall inflation rate. Rising rents and homeownership costs reflect tight housing market conditions and robust demand.

4. Transportation Services

Transportation services saw a 0.6% increase, with higher airline fares and vehicle maintenance costs leading the charge. Supply chain delays for auto parts and labor shortages in the aviation sector exacerbated price pressures.

Deceleration in Certain Categories

While inflation remains elevated, some categories showed signs of moderation:

- Apparel: Prices for clothing and footwear were flat, reflecting subdued demand during post-holiday sales.

- Used Vehicles: After months of steep increases, used car prices declined by 0.3% due to improved supply and cooling demand.

- Medical Care Services: A modest 0.2% increase suggests stabilization in healthcare costs.

Implications of the January 2025 CPI Report

For Policymakers

The Federal Reserve closely monitors CPI data to adjust monetary policy. The January report underscores the challenge of balancing inflation control with economic growth. While headline inflation shows some easing, core inflation remains sticky, suggesting that further interest rate hikes may be necessary to curb demand and stabilize prices.

For Businesses

Inflationary pressures in key inputs like energy, transportation, and labor continue to affect profit margins. Businesses must navigate these challenges by optimizing operations, negotiating supplier contracts, and exploring cost-effective solutions.

For Consumers

Persistent inflation erodes purchasing power, particularly for lower-income households that allocate a larger share of their budgets to essentials like food and energy. Savvy consumers may need to prioritize spending, explore discounts, and adjust budgets to cope with rising costs.

Broader Economic Context

The January CPI report reflects broader economic dynamics, including:

- Wage Growth: While wage increases have helped offset some inflationary impacts, real wage growth remains constrained, as price increases outpace earnings for many workers.

- Global Supply Chains: Ongoing disruptions and geopolitical tensions continue to influence prices across categories.

- Monetary Policy Lag: The full effects of prior interest rate hikes may take time to manifest, complicating the inflation outlook.

Outlook for 2025

Looking ahead, several factors will shape the inflation trajectory:

- Energy Markets: The resolution of geopolitical conflicts and shifts in global energy demand will be crucial.

- Housing Market: Efforts to increase housing supply and address affordability issues could moderate shelter costs.

- Supply Chain Recovery: Improved logistics and reduced bottlenecks may help stabilize prices in goods categories.

- Federal Reserve Policy: Continued vigilance by the central bank will be key to managing inflation expectations.

Strategies for Coping with Inflation

For Consumers

- Budget Planning: Track spending and prioritize essential purchases.

- Shopping Smart: Take advantage of discounts, loyalty programs, and bulk purchasing.

- Energy Efficiency: Adopt energy-saving measures to reduce utility bills.

For Businesses

- Cost Management: Streamline operations to mitigate input cost pressures.

- Pricing Strategies: Communicate price changes transparently to maintain customer loyalty.

- Supplier Diversification: Reduce reliance on single sources to minimize disruption risks.

Conclusion

The January 2025 CPI inflation report provides valuable insights into the ongoing challenges facing the economy. While headline inflation shows some signs of easing, underlying pressures remain significant. Policymakers, businesses, and consumers must adapt to these conditions to navigate the complex economic landscape effectively. Understanding the trends and taking proactive steps can help mitigate the impact of inflation and foster resilience in the face of economic uncertainty.