The IRS adjusts federal income tax brackets annually to account for inflation. Understanding the tax brackets for 2025 can help individuals and businesses plan their finances effectively. This guide provides a detailed breakdown of tax brackets for 2025 in the US, including filing statuses, deductions, and tax planning strategies.

What Are Tax Brackets?

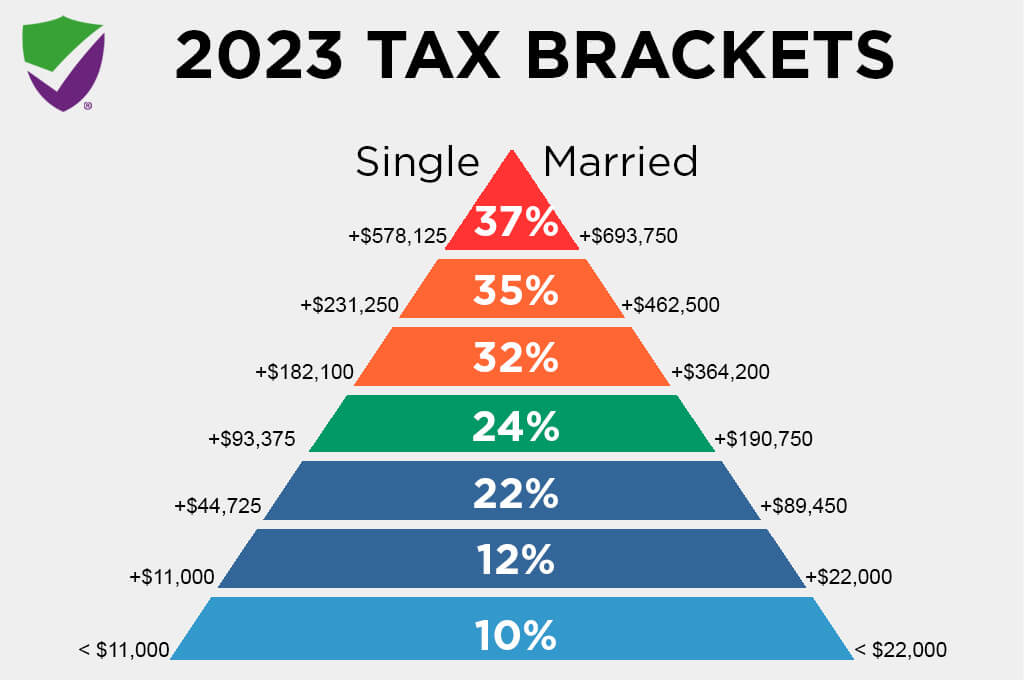

Tax brackets determine the rate at which your income is taxed based on specific income ranges. The US follows a progressive tax system, meaning higher income levels are taxed at higher rates. However, different portions of income are taxed at different rates rather than a flat percentage on the total earnings.

2025 Federal Income Tax Brackets

The IRS has released the updated tax brackets for 2025, adjusted for inflation. Below are the federal tax rates and income brackets for different filing statuses.

Single Filers

| Tax Rate | Taxable Income Range |

|---|---|

| 10% | Up to $11,600 |

| 12% | $11,601 to $47,150 |

| 22% | $47,151 to $100,525 |

| 24% | $100,526 to $191,950 |

| 32% | $191,951 to $243,725 |

| 35% | $243,726 to $609,350 |

| 37% | Over $609,350 |

Married Filing Jointly

| Tax Rate | Taxable Income Range |

| 10% | Up to $23,200 |

| 12% | $23,201 to $94,300 |

| 22% | $94,301 to $201,050 |

| 24% | $201,051 to $383,900 |

| 32% | $383,901 to $487,450 |

| 35% | $487,451 to $731,200 |

| 37% | Over $731,200 |

Married Filing Separately

| Tax Rate | Taxable Income Range |

| 10% | Up to $11,600 |

| 12% | $11,601 to $47,150 |

| 22% | $47,151 to $100,525 |

| 24% | $100,526 to $191,950 |

| 32% | $191,951 to $243,725 |

| 35% | $243,726 to $365,600 |

| 37% | Over $365,600 |

Head of Household

| Tax Rate | Taxable Income Range |

| 10% | Up to $16,550 |

| 12% | $16,551 to $63,100 |

| 22% | $63,101 to $100,500 |

| 24% | $100,501 to $191,950 |

| 32% | $191,951 to $243,700 |

| 35% | $243,701 to $609,350 |

| 37% | Over $609,350 |

Standard Deduction for 2025

Along with tax brackets, standard deductions are adjusted for inflation annually. Below are the standard deductions for 2025:

- Single Filers: $14,600

- Married Filing Jointly: $29,200

- Married Filing Separately: $14,600

- Head of Household: $21,900

The standard deduction reduces taxable income, lowering the overall tax liability.

How Tax Brackets Work with Deductions

Taxpayers can choose between the standard deduction or itemized deductions to reduce their taxable income. If itemized deductions exceed the standard deduction, it’s beneficial to itemize. Examples of itemized deductions include:

- Mortgage interest

- State and local taxes (SALT) (capped at $10,000)

- Charitable contributions

- Medical expenses (if exceeding 7.5% of adjusted gross income)

Tax Planning Strategies for 2025

To optimize tax liability, taxpayers can implement various strategies:

1. Utilize Tax-Advantaged Accounts

- 401(k) and IRA Contributions: Contributions to these accounts reduce taxable income and grow tax-deferred.

- Health Savings Account (HSA): Allows for tax-free medical expense payments if eligible.

2. Capital Gains Tax Planning

Long-term capital gains (investments held over a year) are taxed at lower rates compared to short-term gains. Taxpayers can:

- Hold investments longer to benefit from lower tax rates.

- Offset gains with capital losses to reduce taxable income.

3. Charitable Giving

Donating to qualified charities allows for tax deductions. Donors can maximize deductions by bunching donations (giving multiple years’ worth in a single year) to surpass the standard deduction threshold.

4. Consider Tax Credits

Tax credits directly reduce tax liability and can be more valuable than deductions. Key tax credits include:

- Child Tax Credit (CTC): Up to $2,000 per qualifying child.

- Earned Income Tax Credit (EITC): Benefits low-to-moderate-income earners.

- Lifetime Learning Credit (LLC): Helps offset education expenses.

5. Roth Conversions

Converting a traditional IRA to a Roth IRA allows tax-free growth and withdrawals in retirement. Conversions are taxed in the year they occur, so they should be strategically planned when in a lower tax bracket.

State Income Tax Considerations

Beyond federal taxes, taxpayers should consider state income tax rates. Some states have flat tax rates, while others follow progressive tax brackets. A few states, like Texas, Florida, and Nevada, impose no state income tax, offering significant savings.

Conclusion

Understanding the 2025 tax brackets is crucial for effective financial planning. By leveraging deductions, credits, and tax-saving strategies, taxpayers can minimize their liabilities and maximize their after-tax income. It’s advisable to consult with a tax professional to ensure compliance and optimize tax benefits.